Asia Latest Battleground for World's Top Aircraft Makers

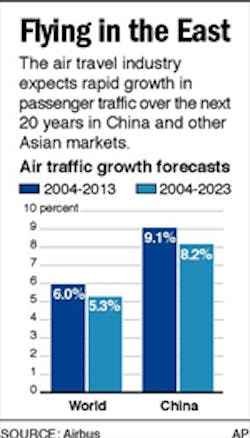

NEW DELHI (AP) -- Airlines across Asia are buying new planes as the region's booming economy spurs demand for air travel, making it the latest battleground for the world's two top aircraft makers: Boeing Co. and Airbus SAS.

Boeing lost several deals to Airbus last year but bounced back this week, winning two major orders - totaling about US$13 billion (euro10 billion) - from the national carriers of India and Canada.

But the battle for the top spot in the world's aviation market is far from over, and analysts say the winner will be decided by airlines in Asia.

Boeing is betting on its newest offering, the 787 Dreamliner, to be available for delivery in 2008. Airbus plans a rival to the mid-size, long-range 787, but it won't be available until 2010. In the meantime, the European consortium is banking on its superjumbo A380.

The A380, which can seat up to 840 passengers, made its first test flight Wednesday and is expected to enter commercial service next year.

''The competition is very much alive. It is going to be fierce,'' said Peter Harbison at the Sydney-based Center for Asia Pacific Aviation. ''In Asia, both (Boeing and Airbus) appear evenly poised as of today.''

A surge in budget airlines, and flag-carriers' plans to overhaul their aging fleets, are driving demand for new planes in Asia, where more than 800 jets are expected to be sold in the next decade.

That number could rise if some countries - especially India and China - speed up the modernization of their airports and the construction of new ones.

''Asia will drive the demand for new planes over the next two decades. India, therefore, is a centerpiece in our growth strategy,'' Boeing's senior vice president of sales, Dinesh Keskar, said after state-owned Air India decided Tuesday to buy 50 new planes from the U.S. aircraft maker.

Boeing estimates India will buy planes worth US$35 billion (euro27 billion) over the next 20 years.

Air India's order - worth US$6.8 billion (euro5.27 billion) minus undisclosed price discounts - was ''a major win,'' Keskar said, adding it may influence future decisions by the country's private airlines, which were recently allowed to fly overseas and are planning to expand fleets.

However, Airbus has had a head start over Boeing in seizing the Asian growth opportunity, especially with the region's low-cost airlines.

Earlier this year, Malaysia's AirAsia Bhd. - the region's biggest budget carrier - signed a purchase order for 60 Airbus A320 aircraft and took options to buy 40 more. AirAsia plans to phase out its fleet of Boeing 737-300s over the next five years. National carrier Malaysian Airline also plans to replace its 737-400s, but hasn't made a choice about 45 to 60 new planes that it would buy.

In Thailand, Airbus has had the edge so far. Thai Airways will have 21 new aircraft delivered by 2009 - 15 Airbuses and six Boeings - said SangNgun Pornpaiboonstid, the airline's vice president of corporate planning. Cebu Air, the low-cost carrier in the Philippines, is in the process of getting a dozen A319s.

In Japan, however, Boeing remains the favorite, partly because Japanese manufacturers have worked for years with Boeing to develop and make aircraft. Japan Airlines, the country's biggest, plans to buy 30 Dreamliners, while Nippon Airways has ordered 50. Boeing also recently won an order for 10 jets, with an option for 10 more, from South Korea's main airline, Korean Air.

Boeing hopes rising energy costs force Asian airlines to look for more fuel-efficient planes, such as the Dreamliner. The company says an airline would save more in the long run with Boeing planes, even though it may pay more when buying. Boeing is believed to be more stingy than Airbus about discounts.

Airbus says it has won more orders in the past two years because its offerings were superior in many respects, including pilot training, maintenance and spare part availability.

Airbus chief Noel Forgeard said the company is confident of overtaking Boeing's 787 with its planned A350, even though the former has an early lead with 237 firm orders. Airbus hopes to get 50 orders for A350 by the Paris Air Show in June, and another 50 by the year-end.

''It is a battle that will last about 20 years - like the battle that occurred between the Boeing 767 and the A330, which we won,'' Forgeard said.

The battle, however, is not limited to corporate boardrooms. National politics and bilateral ties have a significant bearing on airlines' decisions on new planes.

So days before the Air India's board meeting, U.S. Transportation Secretary Norman Mineta visited New Delhi and said Washington-New Delhi relations would benefit if Boeing gets the order. Many saw this week's Air India decision as a balancing act in diplomacy. Air India's domestic counterpart, Indian Airlines, had earlier decided to buy 42 planes from Airbus. That decision had followed a visit by the French prime minister to India three years ago.