Ground Support Worldwide surveyed members of the industry during the fourth quarter of 2021. More than 100 ground support professionals from around the world offered input about ongoing challenges they face, current staffing levels and the condition of their ground support equipment (GSE).

The following pages offer highlights of the data collected during this survey.

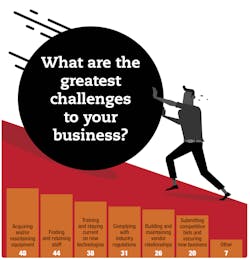

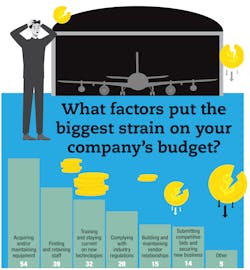

Much like other industries, aviation has grappled with supply chain shortages and staffing challenges. Based on the survey’s results, these issues remain prevalent. Equipment acquisition and maintenance was the most selected response in this survey and staff acquisition and retention was the second highest number of responses (those surveyed were instructed to select all that apply).

As these issues continue, the costs associated with them also rank high among respondents. As new equipment is acquired and new personnel is onboarded, training takes on a larger emphasis and checks in as the third-biggest strain on companies’ budgets.

Other current challenges called out by survey respondents include managing fuel inventory, government regulations and financial assistance.

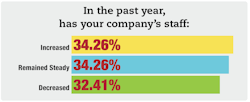

Staffing levels for the majority of those surveyed remained steady or increased in 2021, which is a welcomed development following significant layoffs and furloughs in 2020. However, employee turnover is a continuing trend as 25 percent of respondents hired 26 or more new employees and have taken on the costs associated with onboarding and training new personnel.

At the IATA Ground Handling Conference in Prague, Monika Mejstrikova, director of ground operations at IATA, noted that labor shortage is a frequently discussed topic among airlines, airport and ground service providers. Speaking on the same panel, Azeem Mistry, managing director of airport operations strategy at Delta Air Lines, suggested flexibility is critical to retain qualified ground personnel.

“We’re losing our talent to different industries. We’re losing talent, especially from our skilled positions. We’re losing them to companies that offer a better value proposition,” said Mistry.

“We have to be flexible. We have to de-stress the job,” he continued. “We have to introduce technology that makes the job easier for the employee and the customer. We have to become less transactional. We have to become more experiential. We have to introduce a higher level of safety and a focus on safety that we’ve never done before. Nobody wants to come to work with a risk of getting hurt.”

On the topic of mitigating risk, more than 85 percent of respondents indicate they have a safety management system (SMS) in place and the number of workplace accidents appear to be benefiting from safety measures being adopted and implemented.

An SMS is the foundation of the International Standard for Business Aviation Handling (IS-BAH) registration. Among applicable respondents, more than half of those surveyed have become IS-BAH certified or are taking steps to become IS-BAH registered.

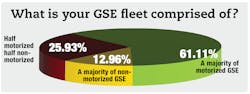

The availability of equipment may be impacting responses. As environmental initiatives have been established and charging infrastructure at airports has increased, a move toward electric and other alternative power GSE as gained momentum. However, survey data shows that more than half of respondents’ equipment is at least 10 years old, and 85 percent of respondents stated their fleets are comprised of either all diesel/gasoline powered equipment or a majority of diesel/gasoline powered GSE.

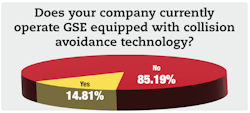

As new equipment with alternative powertrains enters the market, we may see these figures continue shift. The same may prove true for new technology features, such as collision avoidance. Respondents who have adopted collision avoidance technology have primarily purchased cargo Loaders, belt-loaders, passenger boarding equipment and pushbacks and tractors outfitted with the technology.

***

Revenue across the industry can be expected to rise as airline traffic rebounds. Supply and demand would suggest that as passenger traffic increases the need for additional ground support equipment and ground service personnel will also increase. What’s more, an increase in passenger traffic also means in increase in cargo capacity as suppliers can take advantage of additional belly hold space, allowing air freight to improve the supply chain flow.

Whether the workforce can rebound to meet an increased demand is yet to be seen. Where workforce requirements fall short, automation and technology can assist.

More than 75 percent of survey participants stated they were age 50 or older. Even with an aging demographic, the industry appears open to the idea of implementing additional tech. According to respondents, asset management solutions are assisting ground operations, primarily with preventative maintenance, user accountability and security.

Ground support professionals also appear willing to adopt the use of handheld devices, mobile apps and cloud-based applications. Survey respondents indicated the cost of equipment is the biggest deterrent for adopting technology. The cost, time and complexity of training also hinders wider adoption of new tech-based solutions.