Annual FBO Fuel Sales Survey Results and 2020 Industry Forecast

Results of Aviation Business Strategies Group's (ABSG) Annual FBO Fuel Sales Survey indicates that 56% of FBOs in the U.S. and Canada experienced increased fuel sales in 2019 vs. 2018, an increase of 2 percent.

According to ABSGs Principals John Enticknap and Ron Jackson, the overall survey results showed an optimistic FBO industry environment including a record 73 percent respondents feeling confident in the U.S. economy

"There’s no question that 2019 proved to be a very upbeat and positive year for the FBO industry, “ Enticknap said. "The survey showed a continued incremental increase in fuel sales for the fourth year in row for the majority of responding FBOs with a healthy 19 percent of FBOs surveyed reporting an increase of more than 8 percent.”

According to Jackson, the biggest gain was for FBOs reporting an increase in fuel sales from 1 percent to 4 percent over the previous year. “In this division, 24 percent said they saw an increase in fuel sales which is 2 percent more than those reporting in 2018,” Jackson said. “The other segments remained virtually unchanged from the results of our 2018 survey.”

Jackson added that fuel sales were mostly in sync with aviaton business flight activity as reported by ARGUS TRAQPak which tracks hours flown by the business aircraft fleet. "For most of 2019, monthly business aircraft flight activity increased incrementally year-over-date compared to 2018. For the year, flight activity rose slightly registering a 0.9 percent grain over 2018 while flight hours rose 1.3 percent for the same period, " Jackson said. “Flight activity for Part 91 operators, the bread-and-butter group for FBOs, saw 2.3 million hours flown in 2020 representing an increase of nearly 36,000 hours over 2018.”

A new question for the ABSG Survey asked FBOs whether they would be offering Sustainable Alternative Fuel (SAF) to their customers during 2020. The results showed that 80 percent of respondents say they would not be offering SAF with only 3 percent indicating they would while 17 percent were undecided.

“Frankly, this response does not surprise us,” Enticknap explained. “SAF is still very new to the FBO industry and there are concerns among operators as to the availability of the fuel as well as a cost factor. Going forward, we see SAF eventually becoming mainstream as more-and-more aircraft operators adapt and adopt its use, thus increasing the demand at the FBO point-of-sale.”

Another area the ABSG survey explores with FBO operators involves feedback regarding their concerns and greatest challenges facing the industry. An open-ended question resulted in these top five concerns:

1. Staffing Shortages: Trying to find and retain good employees in tight labor market

2. Fuel Margin Management: Pressure from contract fuel suppliers and fuel programs

3. Higher Operational Costs: Insurance premiums, payroll/wages, credit card management

4. Rising Airport Fees and Taxes

5. Environmental Legislation and Political Landscape

An additional section of the ABSG survey is designed to gauge confidence in the economy by FBO operators. A new record of 73% of respondents indicated the economy is headed in the right direction compared to 61% in 2019.

2020 FBO Industry Forecast

Based on the their Annual FBO Fuel Sales Survey, interviews with FBO owners and aircraft operators, and analysis of the oil markets and the aviation fuel industry, Enticknap and Jackson have put together the following forecast for the FBO industry in 2020:

Operators Bullish on Fuel Sales in 2020

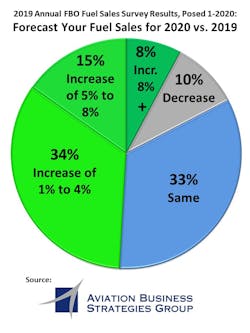

As part of the survey, ABSG asked FBO operators to predict fuel sales for 2020 vs. 2019:

- 33 percent said they expect to have at least the same fuel sales as in 2017

- 57 percent said they forecast fuel sales increases of 1 percent to 8 percent

- 8 percent expect to have fuels sales exceed 8 percent

- 10 percent expect fuel sales to decline

Turbulent Times Ahead

Prior to the COVID-19 outbreak, the resultant international travel bans and a very turbulent oil market, ABSG was expecting to see a moderate 1.5 percent to 2.0 percent growth in FBO business aviation activities to include base customer aircraft movements, transient traffic arrivals and gallons pumped. Argus Traqpak in their 2019 Business Aviation Review issued in January also predicted a robust start to 2020 for business aircraft flight activity forecasting a 4.5 percent increase in the first six months over 2019 for the same period.

However, because of the uncertainty of future events, we will not attempt to make an FBO industry growth forecast for 2020 until we have a clearer picture of the world health and economic landscapes.

Our guidance to FBO operators is to stay the course, conduct business as usual, keep an eye on your margins and continue to provide a safe environment while delivering an exceptional customer experience.

FBO Industry Consolidation

The larger chains have not made any recent substantial moves to expand their FBO networks. However, some smaller and emerging chains continue to add FBOs sporadically through the acquisition process.

Oil Prices

Look for oil prices to be very turbulent through the first half of 2020 with WTI lows now hovering in the low $30s per barrel, and possibly even going lower, as OPEC policy and world heath issues make headlines. As COVID-19 concerns ease in second half of 2020, China’s demand for oil will increase and we look for more stabilized pricing with moderate increases back to the $50 per barrel range later this year.