IADA: Preowned BizJet Market Is Rebalancing

Expectations in the preowned business aircraft marketplace for the next six months have increased, compared to the outlook in the fourth quarter of the past year. That’s according to the First Quarter 2023 Market Report’s global perception survey of members of the International Aircraft Dealers Association (IADA).

Supporting these expectations are first quarter sales results from IADA’s accredited dealers, who routinely buy and sell more aircraft by dollar volume than the rest of the world’s dealers combined. IADA dealers closed 239 transactions in the first quarter of 2023, compared to 288 deals in the same period in 2022, and 213 in the first quarter of 2021.

IADA dealers ended the first quarter with 197 aircraft under contract, compared to 259 a year ago, and 248 in the first quarter of 2021. Interestingly, 52 of the first quarter 2023 transactions experienced lowered prices while only six did the same period a year ago and 27 in the first quarter of 2021. The full report is available for download at https://aircraftexchange.com/.

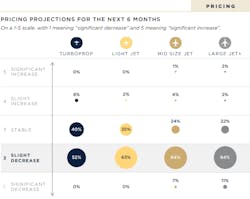

Results from IADA’s first quarter 2023 survey suggest that marketplace forces are at work as expected. There has been some replenishment of inventory levels and a return to more rational pricing and valuations amid an environment of continuing customer interest and inquiries.

Even though macroeconomic forces, geopolitical tensions, and the latest banking crises flood the headlines, customers appear to be little swayed from their interest in buying, selling and flying business aircraft. While 2023 activity levels – aircraft sales, flight activity, MRO shop demand – have generally slipped back from record highs in 2022, the market for business aviation products and services remains vibrant.

“There is evidence that demand and supply forces are rebalancing, with less frenetic activity, more realistic pricing, and a slow but steady buildup of available inventory,” said IADA Chair Zipporah Marmor, Vice President of Transactions for ACASS in Montreal. “Although specific low-time aircraft with attractive pedigrees continue to attract top-dollar, the overall market has begun to downshift from a peak characterized by accelerating prices and strong residual values,” she added.

“Although pre-owned inventory levels have begun to slowly replenish, most OEMs have grown their order backlogs to represent more than two years of production and they are straining to accelerate deliveries in the face of slowly recovering supply chains,” noted IADA Executive Director Wayne Starling. “Our organization foresees a continuation of relatively tight market conditions through 2023, driven by customers who cannot or will not wait two or more years to receive their next aircraft,” Starling added.

IADA began monthly tracking of preowned sales metrics for business aircraft in April 2020 as a result of the volatile market conditions caused by the pandemic. Two key factors inform the report: The first is IADA members’ market perspective, taken from a survey of the entire IADA membership. The second is actual sales data supplied by IADA accredited dealers to support those points of view.