Sandhills Global Market Reports Show Mix of Trends Across Aviation

The most recent Sandhills Global market reports covering used piston single, turboprop, and jet aircraft as well as used piston helicopters in Sandhills marketplaces, indicate that pre-owned jet inventories and asking values continue to rise. At the same time, the used piston single and turboprop aircraft markets are witnessing a pause in asking value increases as inventory levels regain traction. Meanwhile, pre-owned Robinson piston helicopters continue to appreciate in asking value while inventory levels are in flux.

"Aircraft asking values continue to show strength as the seasons change," says Controller Department Manager Brant Washburn. "And despite some variation, the inventory levels we're seeing remain elevated by mid-single to lower-double digits on a year-over-year basis."

Sandhills' aviation products include Controller, Controller EMEA, Executive Controller, Charter Hub, AviationTrader, Aircraft Cost Calculator, and AircraftEvaluator. AircraftEvaluator is Sandhills' proprietary asset valuation tool for all types of aircraft, built using the same technology behind FleetEvaluator. Widely used and trusted across equipment, truck, and trailer industries, FleetEvaluator identifies asset values with unparalleled accuracy.

The key metric used in all of Sandhills' market reports is the Sandhills Equipment Value Index (EVI). Buyers and sellers can use the information in the Sandhills EVI to monitor equipment markets and maximize returns on acquisition, liquidation, and related business decisions. The Sandhills EVI data include equipment available in auction and retail markets, as well as model year equipment actively in use. Effective with the January 2023 EVI, Sandhills introduced version enhancements and weighted adjustments. All historic EVI metrics were amended and recalculated back to 2005, and all calendar year 2023 EVI releases will include these enhancements; as a result, prior numbers will not be comparable to the new, more insightful values.

Additional Market Report Takeaways

This report includes detailed analysis of asking values and inventory trends in used aircraft markets along with charts that help readers visualize the data. It describes and quantifies important trends in the buying and selling of used jet, piston single, turboprop, and Robinson piston helicopter aircraft.

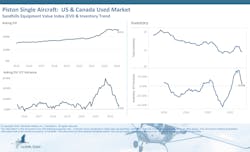

U.S. and Canada Used Piston Single Aircraft

- Asking value increases for pre-owned piston single aircraft have slowed considerably and are almost on par with last year's values. After a slight drop M/M, asking values were sitting at a 3.41% increase YOY in February.

- Used piston single inventory levels slid another 0.11% M/M after consecutive months of a downward trend. However, used inventory levels were 6.35% higher YOY.

U.S. and Canada Used Turboprop Aircraft

- Used turboprop aircraft asking values have topped out a bit in recent months, currently trending sideways and posting a 1.74% decrease M/M. Increases in asking values are slowing down YOY yet remained elevated at 19.32% in February.

- Pre-owned turboprop inventory levels exhibited a 3.54% M/M rise during an otherwise downward trend. However, used inventory levels were 7.83% higher YOY.

Global Used Jet Aircraft

- After a recent dip, used jet aircraft inventory levels posted a 3.92% increase month over month in February and are currently trending upward. Used inventory levels were 132.08% higher in February 2023 compared to February 2022.

- Used jet asking values continue to climb (up 3.6% M/M in February) and showed 12.21% higher figures YOY.

Global Used Robinson Piston Helicopters

- Asking values continue to show strength in the worldwide used Robinson piston helicopter market as consecutive months of increases continued with a 2.08% M/M gain in February. YOY asking values were 10% higher than in February 2022.

- Used inventory levels are gaining momentum YOY, albeit with a 5.06% M/M decrease during a current sideways trend. Inventory levels of pre-owned Robinson piston models were 11.94% higher than last year.