FAA: Of Our Challenges, Funding is #1

WASHINGTON — The forecast is once again bullish, in terms of airline passenger counts in the U.S. So says the Federal Aviation Administration in its annual Forecast Conference held here in March. FAA also is continuing its call for a rethinking of how the U.S. aviation system is funded, specifically calling for a ‘cost-based’ user fee system. That is in line with other moves by the Bush Administration that indicate it is pushing to force industry’s hand when it comes to funding reform.

The annual ten-year forecast projects that mainline U.S. air carrier passenger counts will grow from 738.6 million in 2005 to 1.07 billion by 2017, an average growth rate of 3.2 percent. Domestic enplanements are expected to drop 0.2 percent in 2006, according to FAA.

For air cargo, the agency sees it growing from 39.2 billion revenue ton miles (RTMs) in 2005 to 71.7 billion RTMs in 2017, or growth of 5.2 percent per year. The U.S. cargo fleet is expected to grow from 1,021 aircraft in 2005 to some 1,345 in 2017.

General aviation will see its fleet grow from 214,591 units in 2005 to some 252,775 in 2017, a 1.4 percent annual growth rate. Much of this year’s FAA discussion centered around the expected entry this year of the very light jets (VLJs). The Eclipse 500 is expected to get its Type Certificate by June, and FAA projects that some 100 VLJs will be in service by year-end; the agency expects 350-500 VLJs to enter the market over the next several years.

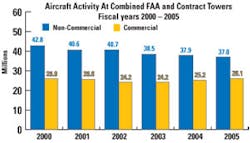

FAA Administrator Marion C. Blakey says the entry of the VLJs is yet another potential strain on the air traffic system. “It’s a certainty that our workload continues to grow,” Blakey told attendees. “Enroute traffic is up 3 percent, and we expect it to stay that way. Over the next few years, we expect general aviation to make another jump because of the very light jets that are in the offing.”

Besides the strains on the air traffic control system, the Administrator also chided past negotiations with the controllers, saying, ‘The last contract left the taxpayer with the short straw ...

“What was to cost $200 million ended up at $1.2 billion. That won’t happen again. We cannot and will not sign a contract that we cannot afford. Salary increases of 75 percent for our controllers are a thing of the past.”

A Cost-Based System

Much of FAA’s dialog in recent months, echoed by Blakey, has centered around a change in how the aviation trust fund, and thus the system, is funded. The formula of relying heavily on the airline ticket tax to fund the system doesn’t work anymore, says Blakey.

“A cost-based revenue system would align the revenue structure with FAA costs,” claims Blakey. She says FAA will soon release its recommendations on what that system should look like.

Meanwhile, Southwest Airlines chairman Herb Kelleher, at a luncheon keynote, told the audience that the Air Transport Association for the first time had come to unanimous agreement on a new formula for funding the system. The proposal was subsequently released and perhaps most notably calls for significant increases for business aviation aircraft, while keeping in place a federal excise tax on fuel for piston-powered general aviation aircraft. ATA’s proposal comes at a time when industry is gathering its arguments to take to Congress for the aviation reauthorization and reappropriation process for FY2008. ATA calls for user fees to be based on arrivals and departures, and how long an aircraft is in the ATC system. The association says that U.S. air carriers paid nearly $9 billion, or 94 percent, of the cost of ATC in FY2004, but used 69 percent — with general aviation paying 6 percent while using 24 percent of ATC services. ATA wants user fees to in turn be dedicated to the aviation system, and calls for the continuing need for a general fund contribution.

Comments ATA president James May, “Trust fund revenues are unpredictable because they depend upon fluctuating ticket prices and aircraft size... As long as there is no direct link between funding and costs, much needed modernization cannot occur.”

GA groups continue to call for continuing fuel excise taxes as a fair method for taxing the sector.