A380, Security Top Reno Agenda

RENO — The double-decker Airbus A380 new large aircraft is expected to enter commercial service later this year and, as such, was a focal point of the discussion at this year’s Airport Planning, Design & Construction Symposium, which brings together consultants, airports, and government officials. Among the other hot topics: new security initiatives by the Transportation Security Administration and new technologies being developed; security lessons learned at airports since 9/11; and, new larger regional jets entering the marketplace.

The annual symposium is co-hosted by the American Association of Airport Executives and the Airport Consultants Council.

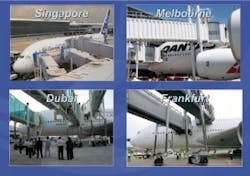

According to Dan Cohen-Nir, the programs director for Airbus North America Holdings, Inc., the A380 is expected to officially enter commercial service by the end of this year, with Singapore Airlines serving as the launch customer. Airbus is preparing to ramp up production to four units per month. It has orders for 159 A380s to date, 27 of which are targeted for cargo-only.

Says Cohen-Nir, “The aircraft was designed for airports.” With the exception of its unusual height, the A380 has very similar dimensions and airfield requirements as the Boeing 747-400. Runway length, he says, needs to be “as good or better than for the 747” and comparable taxiways and ramps don’t require special reinforcement. The A380 can utilize 75-foot wide taxiways, provided shoulders are reinforced. In worldwide tests, says Cohen-Nir, there have been “no pavement loading issues.”

For airports, much of the focus is on handling the aircraft at the gate, from ground handling to passenger loading and unloading. According to Airbus, for ground handling, only two new vehicles are required (tow tractor and an upper deck catering vehicle), and the A380 requires a total equipment count similar to a 747 (21 units versus 19).

The company says that tests show passenger throughput can actually be more efficient than for a 747-400 when using a dual bridge system. Cohen-Nir says that Airbus prefers that airports have one bridge that goes directly to the upper deck — not for Federal Aviation Administration requirements, he says, but for aircraft servicing and customer service. He adds that some international airports now under development are considering adding a third bridge to facilitate turnaround.

Airbus expects that 24 airports will be fully A380-ready by year’s end; by 2010, the company projects that some 67 airports will be ready, 15 of which will be in North America. In the U.S., Los Angeles and San Francisco international airports are expected to first handle commercial A380 operations, in early 2007.

Other questions related to the A380 from Cohen-Nir:

• Noise — “The aircraft is quieter than anything else flying,” he says.

• Thrust — Data shows that there have been no thrust/blast issues on airfields with four engines running. “We haven’t seen any signage problems so far” related to thrust, he says, although tests are ongoing.

• Cost — Cohen-Nir estimates that infrastructure investment at an airport to handle the A380 is averaging some $40 million.

Cases in Point

Meanwhile, Larry Bauman, PE, CM, the Eastern region director for DMJM Aviation, relates the experience of four airports that are in preparation or are planning for the A380:

• At JFK International Airport, the A380 preparation is part of a $147 million airfield infrastructure development. Upon completion, the airport will have four gates that are A380-ready, in Terminals 1 and 4.

• At LAX, A380 preparation is part of an $87 million development program, much of it focused on airfield intersections. Two gates are being made A380-ready. The airport will also have four remote boarding gates specifically for the A380, though Bauman explains the remote handling will bring significant customer service issues.

• DFW will be a second tier airport for the A380 in the U.S., and Bowman anticipates that the airport will have two to six A380 operations per day once operations begin. The recently opened Terminal D was designed to accommodate three A380s. Bauman estimates that DFW will need to invest another $6.2 million in airfield modifications to accommodate the A380.

• At Paris’s DeGaulle Interna-tional, a launch airport, the A380 will be able to operate on four runways, with no need for runway modification, says Bowman. By 2009, the airport is expected to have 14 A380-ready gates in operation, along three dedicated A380 cargo stands.

With Security, a ‘Holistic’ Approach

Much of the discussion from Transportation Security Administration officials and airports centered around integration of systems and processes, and new technology under development. Steve Ropson, a technical director for Raytheon Company, says what’s needed are “holistic solutions” in which all security applications are integrated into a single work station.

Ropson points out that there are new data storage capabilities under development that will facilitate storage and retrieval of information being collected via various security systems at airports. “Planning is becoming more and more important,” says Ropson, because of all of the parties who have vested interests — from the airport to police, fire, tenants, the community.

“Who owns the project in how the project is executed is critical,” explains Ropson. “And project ownership has to be at the right level in the organization.”

At the TSA level, the agency recently completed a “second stage review process,” relates Dr. Randy Null, the agency’s assistant administrator for Operational Process and Technology/CIO/CTO. Dr. Null says that while the agency is “still very much stovepipe,” it is striving to becoming more integrated. One priority: providing a single point of contact for airports to get answers.

Dr. Null says that TSA currently has 24 industrial engineers and 81 IT technicians out in the field under the Office of Operational Process and Technology. A goal is to integrate all the field elements into a customer-engaged group that will be the first resource for airports, fixed base operators, and others.

A major issue facing TSA, says Dr. Null, is that while there are various solutions for specific areas of airport security, it has not been integrated, which limits its overall capability. There is a need, he says, to “fuse” the capabilities into one overall solution.

Dr. Null estimates that industry still faces a $5 billion challenge for complete explosives detection system installation. Congress has called on TSA to devise a strategic plan to address how the installations can be accomplished/financed, and a study is underway to do just that. “Without this study, we’re in an interesting fix right now,” says Dr. Null.

John Beckius, the active branch chief for TSA’s air cargo programs, says that the final rule on cargo security is “very, very close” to being released. He says a “huge influx of activity” prior to the final rule is a reason for its delay.

Beckius says that, among new initiatives at TSA, one is to take a closer look at exempt cargo to ensure there aren’t loopholes that may present unnecessary risk.

Meanwhile, the next generation of explosives detection systems now under development were discussed at the Reno meeting, units that are expected to double the baggage throughput. Among the new EDS units under development:

• Analogic 6400 (an upgrade of the L-3 eXaminer);

• L-3 6500;

• Reveal CT-80.

One question for airports to consider is, can associated equipment/processes keep up with a doubling of throughput?