Aftermarket Post COVID

COVID-19 has severely affected the global economy, but the impact on aviation has been especially devastating. By April of this year, global demand for air travel had dropped by 94 percent year-over-year, and the International Air Travel Association expects airlines to lose $84.3 billion in 2020.

As a result, aircraft MRO services will be deeply affected this year and experience greater turbulence for the rest of the decade. The immediate “demand shocks” for MRO are twofold: First, more than 18,000 commercial aircraft have been parked or stored — two-thirds of the in-service fleet. Second, those that remain in service are seeing much lower utilization: Turboprops, regional jets and both widebody and narrowbody aircraft are operating at 55 to 75 percent of the daily levels seen pre-COVID-19.

As a result, aircraft will see 40 to 50 percent fewer flight hours and flight cycles in 2020, compared to projections at the start of the year. Cumulative fleet and utilization changes for 2020 are shown in Exhibit 1. With aircraft accruing less wear and tear, we estimate that MRO demand this year will drop by half, with a reduction in spend of more than $40 billion.

Deferrals and Vanished Demand

While the entire air transport aftermarket will be impacted, certain segments will be worse off than others. Airframe and engine MRO — the two largest and most expensive segments — will see spend reductions this year of more than 55 percent, as operators selectively choose which aircraft to fly to reduce costs. Wherever possible, operators are preserving cash by deferring maintenance events, particularly heavy airframe work and expensive engine overhauls or LLP replacements.

By the start of the summer, these impacts were already rippling through the aftermarket, with many firms reacting accordingly. For example, the AAR Duluth location, a 190,000 square-foot facility employing more than 300 people, has announced publicly they will close permanently on July 24, citing a lack of demand from a key customer. Along with facility closings, many MROs are planning to significantly reduce headcount. Other announcements include Air New Zealand’s plan to cut 300 jobs from its MRO unit and Boeing’s plan to cut 15 percent of the workforce at its Global Services division. Investments in new MRO facilities have been adversely affected as well: Airbus and Thai Airways recently confirmed they have jointly canceled plans to open a new airframe maintenance facility in Thailand.

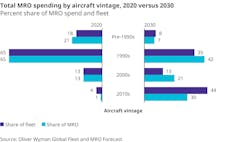

In addition to maintenance deferrals, a portion of expected MRO demand will disappear altogether, as airlines accelerate retirement schedules of non-core or sunset fleets. Several airlines have announced plans to accelerate the retirement of larger widebodies, including Air France, which plans to retire all of its A380s, and Qantas, which will retire all of its 747s by the end of 2020. American Airlines has announced plans to retire nearly 200 aircraft, including 76 of its 737 NGs and 52 of its 757s and 767s.

In total, we expect 2,000 aircraft to retire early as a result of COVID-19, pushing total retirements past 2,500 this year — more than triple 2019’s retirements. Many of these early retirements would have required later-life maintenance events in the pre-COVID market, which by nature are more expensive. These early retirements alone will wipe out more than $30 billion in expected MRO spend over the next decade.

Changing Market Dynamics

These dramatic changes will accelerate certain recent trends in the underlying market. For example, the trend towards narrowbody aircraft will accelerate as narrowbody aircraft are expected to grow to 65 percent of the global fleet by 2025, up from 58 percent in 2020. Moving forward, the outlook for widebody production lines is unclear, as both Boeing and Airbus have announced significant production cuts for the rest of 2020.

Despite reduced production numbers, next-generation platforms — defined as aircraft designed after 2010 — will be more resistant to adverse COVID-19 impacts long term, as a result of their better operating economics. These aircraft will account for one in four planes by 2025, compared to one in 30 today. And they will require substantial maintenance in the second half of this decade, including more than a quarter of 2025-2030 airframe and engine overhauls, compared to just one percent today (Exhibit 2). To prepare for this work, MROs will need to invest to develop the required capabilities to support these more advanced airframes, engines and components, including training for aircraft maintenance technicians.

What Comes Next

Factors such as the epidemiological timeline, future traveler sentiment, government restrictions and the broader macroeconomic environment will drive how air travel demand recovers. An accelerated recovery scenario could see demand recover fully by early 2022, while a more prolonged scenario could push recovery to mid-2023. Global fleet requirements and corresponding MRO demand recovery will depend on which of these scenarios unfolds.

Ultimately, we believe that it will take at least three to four years for a new baseline to become established in the aftermarket. In 2021 — assuming that passenger traffic begins recovery to 80 percent of pre-COVID levels by mid-year — many of the maintenance events deferred from 2020 will need to occur. Increased availability of green-time engines from the glut of early retirements will offset some of these needs, while an increased supply of used serviceable materials will reduce costs, at least in the short-term.

By 2023, assuming COVID-19 effects have normalized, we expect that the aftermarket will be back to nearly the same size as it was pre-COVID and that it will grow by about 2.2 percent per year through the end of the decade. But it will be a different aftermarket, too, requiring personnel with more sophisticated technical and data skills, as operators uses this “market reset” to accelerate the shift to a higher-technology fleet.