Why a ‘Local First’ Approach to Component MRO May Cost More

‘Go local’ is one of the most common – and potentially costly myths – influencing the way operators manage their component MRO. It may seem logical that an airline requiring a component repair in Kuala Lumpur should seek help in Singapore, rather than Montreal, but in fact the numbers seldom stack up.

It’s a Small World

Firstly, there is the misconception that component MRO is all about the time it takes to process and service a part. In reality, parts are rarely repaired while the aircraft waits, so the ‘wing-to-shelf’ time between the part being removed and replaced is the metric that really matters. For example, an Integrated Drive Generator (IDG) can take over four weeks to repair, whereas it can be replaced in a matter of three hours.

When you consider that you are never more than a day away by air courier from all of the major MRO hubs across the globe, it’s clear that shipping parts to the geographically closest market may not make sense. The freight costs may be slightly more, but as a percentage of the total overhaul bill, they are negligible.

Similarly, it’s a false economy to ship a part to a nearby market that doesn’t have the expertise needed to complete the job efficiently. A shop with highly relevant capabilities and experience anywhere in the world is likely to offer better value than a supplier in close range that lacks specialist knowledge and tools. Likewise, a shop in a location with a reliable supply chain may be a better option than a nearby supplier without good part supply.

Of course, there will always be certain parts that are too bulky or hazardous that will need to be transported overland and therefore serviced locally for example, escape slides. However, this is only a very small sample of the thousands of components that operators replace and repair every day.

Aside from generating direct cost savings and benefits by going ‘long haul’ rather than local for parts MRO, airlines and manufacturers are realising that there are a range of ‘hidden costs’ that can be avoided by taking a more strategic and international approach to their parts maintenance.

Taking an Aggregated Approach

Sourcing local providers on a case-by-case basis leaves operators with the headache of managing a whole host of individual relationships with suppliers within the region, potentially including negotiating language barriers and different customs regimes. This is very time inefficient, and it is also tough for operators to ensure competitive pricing due to a small number of regional suppliers.

Time and cost are heavily influenced by the enquiry, logistics and approval process of sourcing a part, which can add to a minimum of at least six days if contracts and agreements are not in place. In response, airlines and manufacturers are increasingly outsourcing their component MRO to aggregators, replacing a web of different suppliers with a single point of contact. A good network, with a pre-agreed contractual framework, can do much of the hard work before a part even leaves the aircraft.

Adopting this approach allows operators to benefit from a standardised quality of service and more streamlined processes. Aggregators are better placed to select the right supplier and can also more easily offer exchange options, avoiding the need to wait for repairs to be completed.

We are increasingly seeing demand from operators for this type of arrangement as it ensures better customer service – in their preferred language – plus savings derived from the aggregator’s ongoing relationships with suppliers, where they benefit from economies of scale and can drive continual improvement and efficiencies.

Taking a global approach to MRO and working with an aggregator allows operators to spend wherever they are likely to see the best return – taking advantage of fluctuations in exchange rates. They can also spread risk by avoiding price spikes driven by regional natural events such as ash clouds and earthquakes.

The Data Dividend

Thinking internationally and more strategically can unlock further benefits for operators as big data and technological advances open up new opportunities.

Large aggregators have access to a huge pool of component data across the aircraft they support and can benchmark operator’s performance anonymously against their competitors. Some airlines with close links to each other are even considering shared agreements with aggregators to derive even greater value from sharing intelligence and pooling resources.

Over the course of a long-term partnership, an aggregator can monitor the true cost of a part failure – incorporating all the hidden costs mentioned above – and can drive efficiencies by drawing on best practice learned through work for multiple operators. They can also apply their expertise, backed by data, to advise on the best course of action; for example, they can assess whether a failure is due to poor use by the operator or whether warranty recovery is worthwhile.

AJW recently partnered with a major OEM to develop an online portal to log and maintain visibility on all its component MRO. Increasingly, we are referring to this type of data-driven, remote partnership as ‘virtual MRO’, since it can mean servicing a customer without touching a single part directly.

We often compare this approach to component MRO to an air traffic control tower, in that it ensures that parts for multiple customers are processed and shipped to their destination in a centralised and efficient way.

This type of partnership also lays the groundwork for effective predictive maintenance. Components often reach MRO suppliers without adequate records, which could see a part removed predictively pass the standard tests and go back into service on the brink of failing. A structured approach to data management and handling can help avoid the risk of this happening.

Conclusion

The aviation industry is notorious for its relentless focus on efficiency and streamlining – from the single olive that allegedly saved American Airlines $40,000 in the 1980s to the no-frills war between low-cost carriers that has recently diversified to include long-haul flights.

You might assume that against this backdrop, operators have iron-clad systems in place to ensure parts are maintained and repaired as efficiently as possible. However, the reality is that MRO – particularly component MRO – is one of the most complicated processes that operators have to negotiate – involving potentially millions of part numbers.

For decades, operators have had to make do by forming patchwork agreements with local MRO providers, but thanks to the emergence of MRO aggregators, combined with advances in technology and data management, operators are finding new and innovative ways of taking on the challenge.

Christopher Whiteside is president and CEO of AJW Group. For more information visit www.ajw-group.com.AJW Group

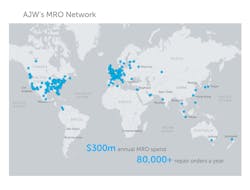

AJW Group is a world-leading independent specialist in the supply and repair of aircraft spare parts, with more than 4,000 commercial and business aircraft under contract across 117 countries.

By establishing mutually beneficial trusted and established partnerships to transform operational efficiency, AJW utilises its trusted and established vendor supply chain relationships and is leading the industry by enabling cost savings and increasing efficiency for customers.

AJW is highly regarded for its 24/7/365 AOG and critical response service excellence and has dedicated sales and service teams located worldwide, along with global stock locations. In addition, AJW has operational hubs in London (HQ), Dubai, Dublin, Miami, Montreal, Moscow, Shanghai, and Singapore. For more information visit www.ajw-group.com.