Recently, the Irish AWAS has announced the sale of its approx. 5 billion USD-worth 100 aircraft portfolio. The Chinese Hong Kong Aviation Capital Co. (HKAC) and Cheung Kong Holdings Ltd. (CKG) are allegedly amongst the main bidders for the deal. Should this prove to be true, 2014 might mark yet a new page in the development of the global aviation as the Chinese financiers are increasingly turning their attention towards the aviation finance market.

The dragon’s growing appetite

Despite the fact that finance markets tend to remain calmer during the summer season, this was not the case this year. Chinese investors were particularly active in issuing announcements about new deals illustrating their growing ambitions in the aviation industry. For instance, China's largest domestic aircraft lessor ICBC Financial Leasing (ICBCL) has announced to double its fleet by delivering over 300 aircraft to various customers by 2017.

In the meantime, apart from the aforementioned AWAS bid, Hong Kong Aviation Capital Co. (HKAC) have already spoken about placing orders for 70 Airbus aircraft worth of over USD 7 billion. At the same time, another Chinese lessor BOC Aviation (BOCA) has just announced its order for a total of 80 Boeing 737.

“While Western leasing companies have been traditionally dominating the global aircraft leasing playground, such a specific market as China is being controlled by local players. The situation has naturally evolved from strict market regulation as well as the fact that both major aircraft lessors and lessees are government-owned. However, the success in air travel development within the country has opened new opportunities for Chinese leasing companies and investors wishing to expand their presence in the leasing segment,” comments Tadas Goberis, the CEO of AviaAM Leasing. “Moreover, these opportunities are being backed by the Chinese authorities. They have recently declared the support for the need to boost low-cost air travel segment. As a result, we might see a demand for extra aircraft which will facilitate the development of the upcoming low-cost projects. At the same time, there are obvious signs that China is willing to further push its major aircraft leasing companies to the international market.”

Following the financial regulator’s approval back in 2007, Chinese financial institutions have been actively developing their leasing activities in the aviation market, topping approx. 75-80% of the local market share today. ICBC Leasing alone, owned by the Industrial and Commercial Bank of China, have enlarged its fleet 6 times (up to approx. 380 aircraft) over the past several years. Meanwhile, the leasing subsidiaries of the remaining Chinese banking “Big four” – CCB Financial Leasing Corporation (China Construction Bank), ABC Financial Leasing Co. (Agricultural Bank of China) and BOC Aviation (Bank of China) - as well as other major players like CDB Leasing Company, China Aircraft Leasing and other are actively observing new opportunities outside their home-market for further growth.

Stepping out, stepping in

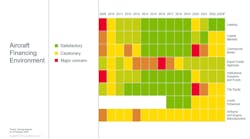

Back in 2011-2012 Ex-Im Bank, ECGD, Coface, Hermes and other alike government-backed export credit agencies held approx. 30% of the aircraft financing market. Today, however, when the financial markets are much more stable and ECA’s fees are on the rise, aircraft operators and owners are willing to explore wider opportunities with regard to financing their deliveries. As a result, the market is enjoying both the growing confidence of traditional financiers (mostly, European banks which are re-entering the market after fleeing it during the financial downturn), and the development of other financial sources, such as capital markets.

In 2014 Boeing expects the aircraft market to require approx. 112 billion USD worth of funding. At the same time, almost every carrier avoids paying for new deliveries in cash (either to support its financial flexibility or due to the absence of own available funds). Thus, the market is being further penetrated by lessors, banks, capital markets solutions, etc.

“Being a Warsaw Stock Exchange-listed company, we ourselves see the growing importance of capital markets and their institutional investors in the industry. We also see that these players, along with commercial banks, are showing an increasing interest in our industry, particularly the segment of aircraft investment. On average, it provides a 10-15% return on investments against the optimistic 4-5% ROI in airline business,” comments Tomas Sidlauskas, Senior Project Manager at AviaAM Leasing.

The know how

However, one must understand that unfortunately the majority of non-aviation investors and commercial banks – which are expected to fund almost half of this year’s deliveries – don’t possess enough expertise within the aviation industry in order to effectively manage the potential risks, including those related to aircraft operation, maintenance, registration and insurance, asset condition and its resources’ control, etc.

“Of course, certain financial players from Europe (and partly from Japan) have already accumulated significant experience in aircraft financing. However, the majority of financiers from the Asia-Pacific, first and foremost China, still lack the experience due to relatively short period of activity in the segment. Thus, in their aspiration for asset diversification and higher yields with lower risks, banks and institutional investors from the emerging countries are increasingly exploring three-party deals: between a financier (lessor), an operator (lessee) and a mediator with a long-standing expertise in aircraft management area. The latter acts as an advisor in creating and, if required, managing the aircraft portfolio on behalf of the owner, as well as auditing its exploitation,” says Tadas Goberis, the CEO of AviaAM Leasing. “All in all, the demand for the funding of aircraft deliveries will increase by approx. one third by the end of the decade. Attracting such funding from outside the industry is an essential condition for the market’s long-term development. Hopefully, through partnership and experience sharing, market players will be able to secure the trust and confidence of non-aviation financial institutions.”

About AviaAM Leasing

A WSE listed global aviation holding company engaged in commercial aircraft acquisition, leasing and sales. Based on its long-term expertise and business experience in Europe, the CIS and other regions, the company offers innovative and individually tailored solutions for aircraft operators, owners and other market players. The company specializes in mid-life mainline narrow-body aircraft as well as high-potential regional jets.

For more information about AviaAM Leasing please visit: http://www.aviaam.com/