Emirates Air Competing With Other Carriers

DUBAI, United Arab Emirates_Emirates was once a money-losing state-run airline. But that phase lasted just one year, 1986, its second year in business.

In each of the 17 years since, Dubai government-owned Emirates has turned a profit, even as it assembled an array of 92 aircraft - one of the world's youngest fleets - and a smorgasbord of 83 destinations.

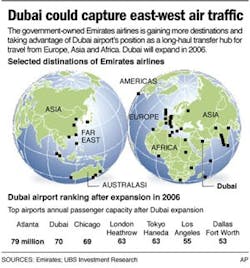

But Emirates' profits, like last fiscal year's whopping 49 percent increase over the previous year, have been overshadowed by its audacious orders for new jets. The airline plans to double in size by 2012, by spending an unheard of $33 billion on 123 new planes, all wide-body jets for long-haul flights, where it will compete with the top European and Asian carriers.

Emirates is an enigma in the airline industry: a government owned Middle Eastern carrier that receives few, if any, government favors. In the Middle East, not usually considered a bastion of bare-knuckle capitalism, Emirates was born and raised in ultra-competitive Dubai, where 110 airlines compete under an "open skies" policy.

"That's how you hone your competitive survival skills. You don't do it by getting all kinds of protection," said Daniel Kasper, an airline consultant in Cambridge, Mass. with consultancy LECG. "That's a feather in their cap to be able to do this in a market that's as open as Dubai."

On Wednesday, Emirates chairman Sheik Ahmed Bin Saeed Al Maktoum is to announce earnings results for the fiscal year ending March 31. Sheik Ahmed said it'll be Emirates' 18th straight year in the black.

Analysts, like JP Morgan's Peter Negline, expect smaller profits this year, tamped down by the high price of jet fuel.

"We wouldn't be surprised to see some moderation in earnings growth," said Negline, who is based in Hong Kong. "But then we see few airlines in our region making healthy profits with oil prices at these levels."

Looking into 2006, Sheik Ahmed predicted more of the same.

"We should see very positive growth, especially in our market - the Middle East and Indian subcontinent."

Americans who haven't heard of Emirates soon may get the chance to fly with them. For now, Emirates operates just two daily flights to New York, but Sheik Ahmed said the carrier will add a third flight this year.

As Emirates' order of 60 long-range Boeing 777s starts arriving, West Coast and Midwest terminals might soon see the carrier's trademark Arabic calligraphy tail logo.

"With the introduction of the 777-LR, we can talk about Houston and Chicago," Sheik Ahmed said. "Over the next six years, we'll be receiving one or two aircraft per month."

Over the past six years, Emirates' capacity and traffic have leaped by more than 25 percent a year as its network spread relentlessly wider.

Now, analysts say Emirates is gearing up to capture traffic from European carriers like Air France, British Airways and Lufthansa, as well as Asian operations like Singapore Airlines, Thai Airways and Cathay Pacific.

A report last year by investment bank UBS said competition from Emirates could spell the end of long-haul flights by less competitive carriers Swiss International, Alitalia and SAS.

Analysts say the airline's growth hinges on political stability, as well as other wild cards such as bird flu outbreaks or slippage in the global economy that would spur messy competition from a growing phallanx of rival Gulf carriers.

"Other airlines have found they've grown faster than they could successfully manage," Kasper said. "When you add that much capacity, you have a lot of risk during market downturns. You can't stop paying bills for new airplanes just because passengers don't show up."

Emirates has used deft management, well-timed purchases, and was poised to take advantage of the energy boom that has turned Dubai into one of the world's fastest growing cities, Negline said.

"There is an element of being in the right place at the right time," Negline said. "But we shouldn't downplay the fact that they had sensible strategies and executed them very well."

Emirates' operating costs are thought to be 40 percent lower than European rivals like KLM, according to UBS. It also benefits from Dubai's investments in infrastructure and zero tax rate, as well as the sheikdom's cheap labor costs. Salaries are kept low by laws that, for now, prohibit unions. Emirates also operates without a less profitable short-haul fleet or legacy costs like pension burdens.

And Emirates looks set to keep its costs down, ironically, by spending around $12 billion for 45 of Airbus' double-decker A380 super-jumbos, the forthcoming long-haul passenger jet with 555 seats in its smallest version. Each A380 is expected to operate around 13 percent more cheaply than a Boeing 747, the UBS report said.

To cope, Dubai is expanding its airport to handle 70 million passengers a year, which could put it behind Atlanta as the world's busiest airport.

Emirates caters to what was until recently an underserved region, with a Persian Gulf airport midway between Europe and Asia. It also consistently brings home awards on its service.

Dubai is a booming destination in its own right - for Brits, the second most popular beach destination outside Britain - with guaranteed sunny weather that draws in tourists and delays few flights.

Emirates focused first on Asia. Its debut destination was Karachi. Now, analysts say Asia is one of the industry's few growth markets. Gulf cities rely hugely on expatriate workers from India, Pakistan, Europe, Australia and increasingly, the Far East and North America.

Emirates and other Gulf airlines are cashing in as more workers flow to jobs here, while stealing passengers from European carriers flying to Asia and Australia, and Asian carriers flying to Europe.

Gulf-based carriers led by Emirates are going to form an ever-larger part of the global airline industry, according to research from JP Morgan.

"European carriers have not seen a competitor like this before," adds the UBS report.

___

AP Business Writer Lauren Villagran in New York contributed to this story.

___

On the Net:

http://www.emirates.com