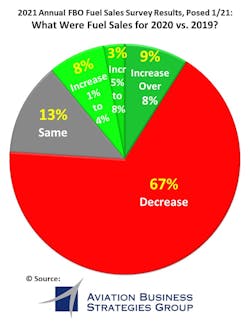

Results of Aviation Business Strategies Group's (ABSG) Annual FBO Fuel Sales Survey indicates that nearly 70 percent of FBOs in the U.S. and Canada suffered a decrease in fuel sales during 2020 vs. 2019.

According to ABSGs Principals John Enticknap and Ron Jackson, the overall survey results showed a depressed economy due to the COVID-19 pandemic with only 20 percent of FBOs reporting an increase in fuel sales.

"There’s no question that 2020 will go down as one of the most economically depressed periods ever in fuel sales for the majority of the FBO industry,” Enticknap said. "This is by far the most negative results we have experienced in the eight years we have been conducting this survey.”

Enticknap said that not all the news was bad as nearly 12 percent of survey respondents indicated that they had increased fuel sales of at least five percent with nine percent having an increase of more than eight percent.

According to Jackson, the fairly robust charter market contributed to the one bright spot in an otherwise down year.

“With the COVID-19 human distancing awareness recommendation, chartering aircraft and the personalized FBO environment became a popular choice as an alternative to airlines and crowded commercial terminals,” Jackson said. “FBOs located primarily in the South as well as recreational and second home destinations reported steady transient traffic that helped buoy otherwise soft Jet A fuel sales.”

According to ABSG, confidence in the economy also suffered a tremendous blow during 2020 as 42 percent of the survey respondents said the economy is headed in the wrong direction with only 18 percent providing a positive response.

“By contrast, the results of last year’s survey showed 73 percent of respondents were positive about in the direction of the economy while only seven percent were concerned,” Jackson said.

A follow-on question from the 2020 survey asked FBOs whether they would be offering Sustainable Alternative Fuel (SAF) to their customers during 2021. The survey results showed that 86 precent of respondents said they would not be offering SAF with only one percent indicating they would while 13 percent were undecided.

“This is similar to the results from last year’s survey, and frankly, this response does not surprise us,” Enticknap explained. “We find there are still a lot of questions from FBO operators regarding the availability of the fuel as well as a higher cost factor. It will be interesting going forward to see if SAF will become mainstream as more-and-more aircraft operators adapt and adopt its use.”

Another area the ABSG survey explores with FBO operators involves feedback regarding their concerns and greatest challenges facing the industry. An open-ended question resulted in these top five concerns:

1. Effects of the COVID-19 pandemic on the economy, transient aircraft traffic and keeping a service team in tact

2. Cost of Jet A and Avgas going up and economic inflationary concerns

3. More government regulations, rising airport fees and increased taxes

4. Increased insurance premiums and lower cash flow

5. Effect of green energy rhetoric could slow economic recovery and stymie flight department activity

2021 FBO Industry Forecast

Based on their Annual FBO Fuel Sales Survey, interviews with FBO owners and aircraft operators, analysis of the oil markets and the aviation fuel industry, Enticknap and Jackson have put together the following forecast for the FBO industry in 2021:

- FBO Operators Indicate a Slow Recovery for 2021

As part of the survey, ABSG asked FBO operators to predict fuel sales for 2021 vs. 2020:

- 39 percent said they expect to have at least the same fuel sales as the depressed numbers in 2020

- 18 percent expect fuel sales to decline

- 22 percent said they forecast fuel sales increases of one percent to four percent

- 11 percent said they forecast fuel sales increases of five percent to eight percent

- Nine percent expect to have fuels sales exceed eight percent

- Oil Prices

Look for oil prices to increase through the first half of 2021 with WTI quickly passing the $60 per barrel mark and approach $70 a barrel as oil markets tighten, U.S. oil production stagnates and consumer demand begins to outstrip production.

- Prepare for Inflationary Trends

With fuel prices on the rise, the cost of moving consumer and staple goods will increase due to higher transportation costs. This will cause an inflationary effect that could exceed three percent and possibly four percent.

- FBO Industry Consolidation

With the pending sale of the Atlantic Aviation FBO Chain, look for some of the Atlantic branded FBOs to be sold separately should an FBO chain get involved in the purchase thus forcing the divestiture of same-field duplicate facilities. Some smaller and emerging chains continue to add FBOs sporadically through the acquisition process.

- Jet A Fuel Prices and SAF

Jet A fuel prices will be irregular for most of the year and will generally follow the price of oil as in the past. FBOs will need to be mindful of what is in their inventory and adjust their fuel margins regularly. Also, Sustainable Alternative Fuel (SAF) is here to stay so plan to add this fuel to your inventory as demand from aircraft operators increases.

- Trend: FBO Selection Based on Safety and Health Standards

In the present and post COVID-19 environment, aircraft operators, particularly those flying internationally, will become more selective in choosing FBO service providers in favor of those with a minimum of at least a safety management system (SMS) and/or an IS-BAH registration designation. This is due in part to perceived health and safety measures in place.