Concessions Update

ORLANDO - Earlier this year, some 300 representatives of airports and the companies that specialize in retail and concessions met at the debut Revenue & Operations Conference, hosted by the Armbrust Aviation Group. Among the leading points of discussion: rates & charges; the RFP process; and options for providing wireless service to passengers. Representatives of several major airports undergoing major concessions renovations and additions were also on hand. Here are the highlights, followed by various retail-related news briefs.

William Anton, founder of Wash-ington, D.C.-based Anton Airfood, Inc., put the importance of the industry segment into perspective, pointing out that the restaurant business is the largest private sector industry in the U.S., with some 12.4 million employees. Restaurants are also the nation's largest employer of women, says Anton.

Meanwhile, presenters from Portland, Miami, and Baltimore-Washington International Airports shared insights into the scope of major concessions projects at their respective facilities - an indicator of the ongoing and increasing role that retail and food and beverage concessions are having on airport revenues.

And, according to Paul Weber, international retail director for BAA plc, the British firm often credited with starting the concessions revolution at airports, U.S. facilities have the potential to generate even more revenue from retail in terminals. According to a BAA analysis, he says, U.S. airports could potentially generate another $1.9 billion in revenues annually by reevaluating what they have in place. As an example of the uneven approach being taken by U.S. airports as a whole - and large airports, in particular, Weber points out that of the busiest U.S. airports, only three of the Top 10 in sales per passenger are also in the Top 10 in passenger movements. He reports that BAA annually generates more than $7 billion in concessions sales at its seven U.K. airports.

According to Weber, U.S. airports on average generate $6.44 per passenger; however, he projects they could average as much as $10.08 per passenger.

Reevaluating the RFP process

Regarding the request for proposal process, BAA's Weber says that too often the RFP process focuses too much on the needs of the airport rather than on the needs of the customer. He also points out that oftentimes an airport will put out an RFP on poor commercial space and give little consideration to how it will actually perform commercially. "It wouldn't happen in a successful mall," he says, "so why should it happen here?"

Most importantly, he says, the airport needs to promote competition to increase sales. "Competition is the way to change the game," he says.

Prior to issuing an RFP, says Ray Diaz of Miami International's properties division, an airport needs to benchmark itself against the rest of the industry, including both airports and the retail sector as a whole. He also recommends having an "industry input meeting," such as the popular peer review sessions held around the country, in which other airport managers evaluate the plan.

Diaz says that a key evaluation tool in the process is to put together a selection committee made up of various community representatives, including the Chamber of Commerce, economic development groups, airport staff, and others.

A couple of examples given by attendees on how to improve the selection process include:

- At BWI, BAA put together a $1 million fund to help finance small business start-ups; and

- At DFW's new international terminal, set to open this year, the airport developed a criteria that analyzed a small business's ability to sustain economic downturns, thus disqualifying many in the process.

Trends

Concerning what types of food mix airports should consider featuring at their facilities, Dr. Tim Ryan, president of the Culinary Institute of America, says, "What we're interested in is trends. Ethnic food is hot."

Bold, brash, spicy food is 'in,' says Ryan, as is vegetarian. Fragmentation is also occurring in the marketplace, whereby a successful Asian restaurant can lead to sucess with various derivatives, such as Vietnamese, Chinese, etc. At the same time, however, he says a traditional mix is also necessary, because in times of stress - the airport experience - many consumers, particularly women, seek out "comfort" foods.

Scott Kilgo, senior manager of concessions for Portland Internation-al, says that broadening the selection can significantly impact increased revenues. When doing so, he echoes the sentiment of others that it's important to look off-airport for trends in the overall food marketplace.

Wireless

Pam Brown, vice president of Airport Network Solutions, says that when looking at providing wireless service to passengers, it's critical to recognize that consumers "prefer reliable, high-speed versus a free wireless network."

Her "single most important recommendation" is for an airport to get an accurate evaluation of what customers want in the specific airport market by measuring current cellular traffic. Then, an assessment of revenue versus service can be achieved, she says.

NASA lands at Orlando

Orlando International Airport, with the help of astronaut Gene Cernan, opened the NASA Kennedy Space Center Store, the first destination-type store that allows airport visitors to explore one of America's most beloved destinations while they wait for their flights. In this one-of-a-kind retail destination, travelers can touch a piece of Mars, interact through videos exploring distant planets, shop for loved ones, or educate their children about the wonders of outer space. The store is operated by Delaware North Companies Parks and Resorts.

At Phoenix, Terminal 4 is 'hot'

The hottest retail center in the Arizona Valley doesn't have a Tiffany & Co., Ralph Lauren, or Louis Vuitton.But shoppers just can't seem to pass up retail inside Sky Harbor International Airport's Terminal 4, where T-shirts, books, and gum, generated some $1,689 per square foot in 2003. Not counting food, Terminal 4 retailers pulled in a healthy $28.4 million. One 400-square-foot newsstand rang up nearly $1.6 million.

Massage Bar popularity continues

Established in 1993, Massage Bar, Inc. operates seven locations providing seated massage. In August 2003, Massage Bar rolled out a new brand image, focusing on the 'natural and inviting.' The image features rich colors, textures, and materials including golden bamboo, three dimensional natural murals, and recycled rubber tire flooring.

Airport locations include Seattle-Tacoma International, Concourse C and North Satellite; Nashville Inter-national, Concourse C; Newark Liberty International, A Terminal; Newark Liberty International, A-3 Connector; and Washington Dulles International, Concourse B; www.massagebar.com.Paradies - 45 years and counting

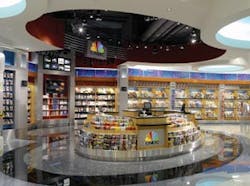

The Paradies Shops, an Atlanta-based airport concessionaire operating over 400 stores in 61 airports across the U.S. and Canada, is a family-owned business established in 1960. With experience in operating both local and national brands, including CNBC, PGA TOUR, Brooks Brothers, Brighton Collectibles, Harley Davidson, and The New York Times Company, The Paradies Shops maintains a presence operating in more airports than any other retail concessionaire; www.theparadiesshops.com.New shops at BWI

The AIRMALL at the Baltimore/Washington International Airport (BWI) recently introduced Charlie Chiang's KWAI and Mayorga Coffee as the latest local brands opening up shop. They join the ranks of international retailers - Auntie Anne's Hand-Rolled Soft Pretzels, Borders, Nectar, and Sunglass Hut - also opening new locations at BWI. The new retail and concessions program, being phased in over the next 18 to 24 months by developer BAA Maryland and the Maryland Aviation Administration, is part of the state's $1.8 billion capital expansion program at the airport.

An eye on taxes

Buying a burger at Louis Armstrong International Airport could get a bit more expensive if the legislature approves a bill being pushed by Kenner Mayor Phil Capitano to raise sales taxes at the facility to nearly 14 percent. The tax would affect car rental companies doing business at the airport as well as concessions. The bill would let the Kenner City Council increase a special airport sales tax from 2 percent to 5 percent, increasing the total sales tax at the airport to 13.75 percent. The sales tax rate in the rest of Jefferson Parish is 8.75 percent.

Company briefs...

Anton Airfood Inc., an award-winning airport food and beverage concessionaire, now has operations in 21 airports in North America ranging from upscale to branded casual dining, branded coffee or QSR. The company is able to custom develop a program for any size airport with national, regional and original brands; www.airfood.com.SmartConnect, a leading provider of video-centric business intelligence solutions, announces the availability of Restaurant Vision On Demand, a loss prevention system that helps restaurant operators combat the ongoing problem of employee theft. SmartConnect's Restaurant Vision systems help operators turn video surveillance into a proactive, efficient loss prevention tool; visit www.smartconnect.net.Unison-Maximus, Inc. has experience planning, implementing, and managing airport retail concessions. At more than 40 airports nationwide, the company helps airports increase revenues and passenger satisfaction by creating programs that address the individual needs of each airport client. For more information, contact Judith Byrd, sr. VP, 312-988-3360, ext. 28; http://unisonmaximus.com.