Hot Market, New Players

The acquisition frenzy among fixed base operators continued this spring. It wasn’t long ago that Butler owned the FBO universe; then Van Dusen; then Signature Flight Support ... now Macquarie? And what of the couple dozen FBOs expected to be put into play if Dubai Aerospace successfully acquires Landmark? As the landscape changes, two items of note: 1) the persons behind the scenes may not be new faces; and 2) the persons behind the money very well could be. To help assess the current FBO market, we went one on one with Jim Haynes, president of The Aviation Group, based in Leesburg, VA.

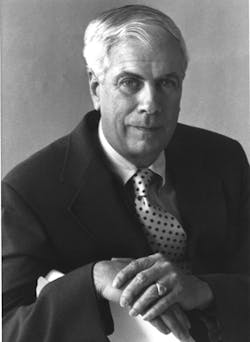

Haynes, 70, is a former FBO owner and chair of the National Air Transportation Association, and a banker. A former Navy pilot, Haynes founded Janelle Aviation at the Leesburg Municipal Airport, which he also managed. His firm specializes in evaluating FBOs for prospective buyers, and advised Macquarie Bank, an Australian investment firm, during recent acquisitions, among others. Following are edited excerpts ...

AB: What has your company been seeing in the FBO marketplace?

Haynes: Things are good in the industry; business jets are being built. More people are flying; but the infrastructure isn’t there to handle it.

We’re still involved in what I call the M&A game – mergers and acquisitions. I can’t really talk about deals that we’re involved with, but it’s very busy. The consolidation is happening. Things that were going to bring change have pretty much occurred.

The first phase is where you have the consolidation of the smaller companies. The best example is Macquarie, who was just getting started in 2004-05, when they made their first acquisition. Now they will have 60 bases when they close Mercury Air Group, which they’re buying from Allied Capital. That’s the biggest FBO chain in the United States, and it’s happened in three years.

Then you have Landmark — I had some questions about that model from day one. The beauty of the Macquarie model is they are focused on fuel and line service; that’s what they do. Landmark was a conglomerate of doing just about everything in GA except build airplanes.

Carlyle put that together and it never quite worked. They tried to sell Piedmont-Hawthorne several times and ... decided they’d correct the problem so that the company was marketable by rebranding it Landmark. They even made some additional acquisitions, like Garrett.

I don’t think in this industry it’s necessarily true that where you buy your gas you get your major maintenance checks done. That never made any sense to me.

Now they’re selling to Dubai Aerospace. The first thing they’ve announced that they want to do is to sell off the FBOs.

AB: Word is, they’ll be forced to sell off the FBOs to get the regulators to agree to the deal.

Haynes: I haven’t heard ‘have to;’ I’ve heard ‘want to.’ Look who’s buying it — Dubai Aerospace. And who’s running it? Bob Johnson, who came from AlliedSignal/Honeywell? Follow that trail and he’s not an FBO guy; he’s an M&O guy. As you look at the Piedmont-Hawthorne FBOs, they’re not really giants. You’ve got three fairly large bases; then you’ve got, God love ‘em, Leesburg.

AB: If the Landmark deal goes through and 24 FBOs are put into play, what does that do to the market?

Haynes: Somebody will buy them. At what price, I don’t know. Sure, we’d take a look at it. We’ve taken a look at Piedmont-Hawthorne.

AB: What are your thoughts about all the new money looking at FBOs for investment?

Haynes: Institutional investors are looking at this industry. Early on when I first started it was individuals who would call me up and wanted to buy an FBO. But I don’t hear from those people anymore; I don’t think they’re there. Some people occasionally want to start up an FBO. Starting up green is really tough these days.

AB: With new players does there come a difference in expectations?

Haynes: I wouldn’t say it’s naive. They’re using business aircraft more and are asking, what about this industry? Is there something there?

AB: What about reversion clauses — are they something that affect how outside investors look at FBO investments at U.S. airports?

Haynes: They all worry about it, but they get over it. As long as there’s a long-term lease, 15 to 20 years or longer, it’s not a big problem. The question is asked almost every time.

AB: What about the values of FBOs in the market today?

Haynes: No question that the values have been increasing, but so have the businesses. The FBOs are making more money, so the values are going up. Multiples are going up, but there’s a lot of misinformation being spread around about what a particular property was sold for.

AB: Where do the opportunities lie in the FBO market?

Haynes: Where the needs are -- to service all these turbine airplanes that have been built and continue to be built. One of problems the VLJs have is they have no support system.

With maintenance, the investment up front is a challenge; but it’s also an opportunity, because there are a lot of these airplanes. I think that’s why you see Dubai Aerospace being interested in the Garrett part of the business, but not so interested in the FBO part. They’re already there; they have the infrastructure.