NEW ORLEANS — The 15th Annual Boyd Group International Aviation Forecast Summit drew record attendance for the 15th straight year, with some 60 percent of attendees having been present at the event in the past. Attracting aviation officials worldwide, this year’s conference was represented by eight countries, 75 airports, more than 30 airline representatives, and five aircraft manufacturers.

“You keep hearing about the virtual airline ... it’s already here,” comments Mike Boyd of the Evergreen, CO-based Boyd Group, an aviation consulting and forecasting firm. “Today it is possible to buy a ticket on airline X, and never deal with airline X’s employees — you’re dealing with vendors and what not. Your reservations are made through the Internet; you’re checked-in by a kiosk; ramp handling is usually outsourced, maybe not even by airline people.”

Boyd says the airline industry today is housed in silos ... with a lot of the industry being farmed out. “Even within an airline, the various departments have departmental goals, not customer goals,” explains Boyd. “I maintain many airlines don’t have customer service anymore, they have departments of customer compliance.

“We are looking at a whole new paradigm for airports, which is we have to manage every part ... it can’t be random anymore. That means we have to change how we do business.”

Industry trends

On the issue of a potential pilot shortage, “Certainly there’s going to be a tremendous cost-push [referring to safety-related legislation regarding rest for pilots and flight experience requirements]... look at the growth of the regional [airline] industry as we know it; arguably it was a bubble that was born on the backs of low wages and growth for the sake of growth,” remarks MIT research engineer William Swelbar.

Adds Boyd, “Compensation must go up dramatically to attract and keep people in the profession; traditional airline entry-level ‘regional’ airlines will need to materially increase compensation levels … meaning the cost of the operation of small airliners goes up even further, thus the range of missions they can economically operate shrinks, and so scheduled passenger air traffic will shrink.”

On the airport side of things, JBT Aerotech vice president John Lee relates an interesting phenomenon happening at Sea-Tac, which is looking at buying all electric ground support equipment (some 690 pieces of equipment) and leasing it back to the airlines.

“When you’re electrifying, you have to get the infrastructure in place,” explains Lee. “For each individual airline it wouldn’t be economically conducive to do that — but for the airport to take on that role ... to put in the infrastructure, buy the equipment, and piecemeal it out to the airlines, I think is a very interesting model.”

With regard to the funding of airports, says Swelbar, “We have some 450 commercial air service airports on the mainland; 40 percent of those airports equal 97 percent of domestic demand ... 60 percent then have 3 percent of demand, yet they are competing for the same funding.

“As we start to see cost-push on the regional side particularly, there are going to be markets that are just uneconomic to serve — so should we maybe be thinking about regionalizing airports.

“Capital needs to be smarter; it’s finite. The trend around the globe is the concentration of air service around the largest metro areas — that’s going to continue to filter down even into the smaller communities. [Congressman James] Oberstar defined essential air service in 1978 ... maybe it’s time to define a new essential.”

Forecasting; global fleet trends

Some airline market dynamics identified by the Boyd Group include:

1) Decision drivers will start with sector costs, not seat capacity;

2) Mission flexibility will be increasingly important, more so than just matching capacity with demand;

3) The future is alliance-related imperatives; projections of fleet needs by global alliances may be part of coming forecasts.

In terms of new aircraft demand by region, Boyd predicts that from 2011 to 2020, North America will need 4,093 aircraft; Europe will need 3,973; and China will need 3,713.

Remarks Boyd, “There are about 18,000 airplanes in the fleet today globally; we think it’s going to grow to about 24,000 in the next ten years — 40 percent will be replacement of older airplanes and the remainder will be what we project to be growth. That’s 33 percent more airplanes in the sky [majority projected for China].”

With regard to aircraft type, Boyd says the 126-180 (basic narrow-body) seat category will see most of the growth. Another note to consider, comments Boyd, “In North America, we are going to see a decline in fleets during the next three years, because we will be seeing a lot of retirement of jets.

“Expansion of global alliances will allow pooling of equipment, ostensibly leading to better utilization of twin-aisle fleets, and less demand for new units.”

Also, adds Boyd, there is major uncertainty regarding the ultimate production of viable airliners in the 70-125 seat category. This could result in major up-shifts in unit capacity, and changes in airline operational strategies, he says.

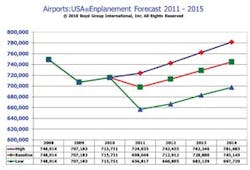

In forecasting traffic for North America, Boyd predicts enplanements to be 1 to 1.5 percent up this year, and may be down in the coming year — mainly because capacity will drop a little bit. “What that means is higher fares; fuel prices will go up; labor will go up ... and the result of that is we will see traffic drop.

“The good news for U.S. carriers is, I think they can handle it. If we do go back into a major recession, virtually every U.S. carrier has capacity it can pull out.”

During the next five years, Boyd projects total passengers to increase by 9.2 percent (expansion will track at 2.4 to 2.7 percent through years 2012 to 2015), with most of the growth gravitating towards larger cities.

“It’s hubsite airports that are going to grow the most,” says Boyd. “We have stability, but we don’t see anything on the horizon that says we are going to see major growth.”

About the Author