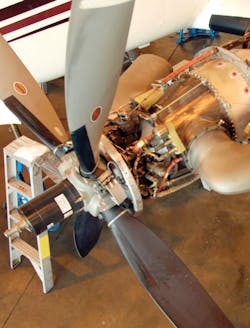

Maintenance departments no longer are viewed only as the group that maintains aircraft. Today they play a pivotal role in the financial aspects of any operation. Major spare components such as engines, landing gears and propeller assemblies are expensive capital intensive assets that present a major investment decision.

What was once a less challenged decision just 10 years ago, the decision to buy, lease, and exchange high value assets today deserves thorough technical and business case review.

With continued pressure to preserve cash and contain costs, operators and service centers look for resourceful ways to invest less on spare parts while improving service recovery response time. The opportunity exists for asset management companies to play a vital role; one which provides timely, cost-effective spare parts support through exchanges, leases and sale/leasebacks. To learn more about spare part asset management, I sat down with Steve Hendrickson and Newcastle Aviation.

AMT: How can a company like yours manage expensive spares more economically than the operator or service center?

SH: Well, our core business is asset management and we do it very well. For example, an operator’s removal forecast may call for needing one spare engine, landing gear or prop assembly over a two year period. Depending on the asset the value could be millions of U.S. dollars.

Many operators view spares as necessary to support their operations. However, if an asset is sitting idle on the shelf, there’s an opportunity cost associated with it. If the asset is financed, it is most likely accruing interest expense. Or if the asset is free and clear, it could be sold to free up capital needed to run the company’s core business. Through spares pooling we combine the demand forecasts of multiple operators, and provision our spares pool to cover those needs accordingly. We custom tailor a spares support program that meets the needs of our customers.

AMT: How do you manage your spares level?

SH: It’s a dynamic process that requires constant monitoring. We use statistical Poisson distribution modeling to determine the number of spares required to meet specified service levels and the needs of the pool. When properly managed, the pool concept is economically more advantageous to its members because fewer per-capita spares are required to achieve the same service level than if they were not in the pool, and the pool spares are being utilized more steadily. As we add customers to the pool, the same modeling is used to determine when we buy additional assets.

AMT: How else does the pool concept benefit the operator or service center customer?

SH: We also offer repair management services. We utilize the economies of scale leverage of our spares pool to negotiate favorable repair/overhaul terms with the repair agencies we use - not with just one, but a minimum of two shops. Quality being equal (uncompromising), we’re able to keep our shop visit costs and turn-around times competitive, which translate to lower operating costs for our pool customers.

AMT: Explain the difference between short-term leasing and exchanges?

SH: They both provide one common objective; immediate access to expensive spare components on demand. Short-term leases are used by operators and service centers that have a short-term operational (versus financial) need for the spare. Reasons for leasing vary, but most often it provides operational coverage while the operator’s component is in repair or overhaul. Following repair, the leased component is removed from wing and returned. This option is more desirable for operators or service centers that need to have their original component back after the shop visit. The primary difference with exchanges is title to the asset is swapped at the point of exchange and the operator or service center will not get their original core back.

AMT: Are there different kinds of leases?

SH: I prefer to classify component leases into two categories – short-term operating leases and long-term finance leases. Short-term operating leases have a term of one to 12 months and provide flexible, cost-effective spares support during the repair/overhaul of the operator’s component, or the lease may be required to supplement existing spares during fleet expansion. The lease rate is typically made up of daily rent and a maintenance reserve. The daily rent portion is a fixed dollar amount paid per day and the maintenance reserve is most often a fixed amount per hour and/or cycle of operation.

Long-term leases of one to 10+ years are otherwise known as finance or capital leases. The long-term lease is an alternative to outright ownership and is a way to finance or lease an asset over the long term. In most leases, the asset is returned to the lessor at the end of the lease term. Some leases allow the operator to buy the asset at a predetermined price at the end of the lease term. The lease rate is made up of monthly rent. Most long-term leases do not collect maintenance reserves but instead include specific return conditions for part condition, configuration, and remaining life requirements. Often times there is a buy-out provision which allows the end user to pay for any return conditions not met.

AMT: What are the different kinds of exchanges?

SH: Flat rate exchanges are offered to operators and service centers for a flat fee, with limitations. Included in the exchange fee is access to the ‘ready-to-install’ spare and it pays for the ‘standard overhaul cost’ of the operator’s removed core, excluding charges for work considered ‘over and above’ a normal overhaul workscope. A flat rate exchange is relatively simple for the operator or service center to manage logistically because they’re not required to deal directly with the shop. They provide predictable exchange/overhaul cost structure for budgeting and forecasting purposes and are favored by customers that prefer a simple repair management process.

Cost plus exchanges charge an exchange fee plus the actual cost of the overhaul of the customer’s asset. This method provides the customer a less predictable exchange/overhaul cost structure for budgeting and forecasting purposes – but the customer reserves the right to dispute any charges that do not seem fair and reasonable. Cost plus exchanges are the actual cost of the overhaul and are preferred by customers with a hands-on approach to reviewing overhaul invoices.

AMT: What are the major parts of a lease and exchange agreement?

SH: Although these agreements are written for many different types of transactions, the three major parts are: business/operations, legal, and risk management. The business/operations portion of a contract covers items such as: contract term (start/end dates): exchange/lease fees, payment terms, delivery and redelivery terms, shipping and storage requirements, and maintenance, repair, and records requirements. The legal section addresses liability and indemnification, warranties and representations, legal jurisdiction, exportation, taxation, contract termination, notices and dispute resolution. Risk management deals with property, public liability, product liability and completed products, and war risk insurance coverage. It’s important for maintenance departments to be involved in the details of the business/operations portion of the agreement.

AMT: What are the key aspects maintenance personnel need to be aware of regarding lease and exchange parts?

SH: Whether you are purchasing, leasing, or exchanging a component, your plans for use of that part remain the same - to install it on wing and return the aircraft to service.

First, ensure that the component part number and description you are leasing or exchanging is the component you actually need. Careful review of the part and its airworthiness records are essential to ensuring that it is airworthy and in the correct configuration for your operation. Such records include the current return to service EASA Form One, TCCA Form 1, or FAA 8130-3, SB/AD status, configuration or modification status, PMA parts status, LLP or CLP status, requested trace to birth documents, and test cell/MPA run data, etc. Reliance is put on the top level airworthiness tag - and rightly so. But that shouldn’t substitute a careful review of the records beyond that certificate. Another point is the facility that approved the return to service paperwork. Are they required to be added to your organization’s approved vendor list? If you don’t recognize the shop take the time to verify the status of the repair station certification and capabilities.

AMT: What is the trend for asset leasing and exchanges going forward?

SH: Operators and service centers will continue to manage operating expenses, improve operational flexibility, and lower the overall cost of ownership. The benefits of participation in lease and exchange pools can produce significant results. But the first and perhaps most difficult questions for the operator or service center to ask are: Are we fully utilizing that expensive capital intensive asset sitting there or is there some unanswered conviction to let it remain there? And what is that really costing us?

Newcastle Aviation Partners is ISO9001 and AS9120 certified specializing in the aftermarket support, sale, lease, and exchange of commercial, regional, and general aviation jets, turboprops, helicopters and related systems, components, and piece parts. Newcastle Aviation also acquires and re-markets on behalf of its customers and clients worldwide all varieties of aviation and aerospace assets. For more information call (952) 223-0317 (USA) or visit us at www.newcastleaviation.com.