Bradford Airport Logistics (“Bradford” or the “Company”), a leading provider of advanced logistics services to airports and other transportation hubs through its proprietary Centralized Receiving and Distribution Centers (“CRDC”) model in the U.S. and internationally, announced that it received growth equity financing from BBH Capital Partners, a private equity strategy of Brown Brothers Harriman (“BBH” or the “Firm”). The financing will help Bradford pursue significant growth opportunities including a new strategy for a Design, Build, Operate (“DBO”) model for CRDCs, and will allow capital to be easily deployed as future opportunities materialize.

"We are thrilled to welcome the talented BBH Capital Partners team during an exciting period of growth. With a long heritage as a privately-held, owner-managed general partnership, BBH’s core pillars align perfectly with Bradford’s and will help build a successful strategic and financial partnership," said Benjamin Richter, CEO and Founder of Bradford.

Matt Salsbury, Senior Vice President at BBH added: "Our team is committed to helping Bradford continue to execute its innovative vision and realize its growth potential in the coming years. Bradford has worked tirelessly to build a superior product and create an exceptional culture among its employees. Their success has been reflected in the impressive proliferation of their CRDCs across airports worldwide and in their unmatched customer satisfaction."

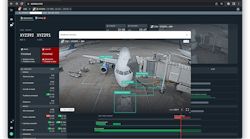

Bradford currently operates fourteen airports in the U.S. and a joint venture at London Heathrow in the UK. The Company also provides screening of concessions and retail goods entering the airport terminal complex to increase security.

Imperial Capital served as the exclusive financial advisor to Bradford in the transaction.